It is possible to invest in real estate and reap those benefits without all of the headaches of being a landlord like dealing with tenants, toilets, and termites. But how?

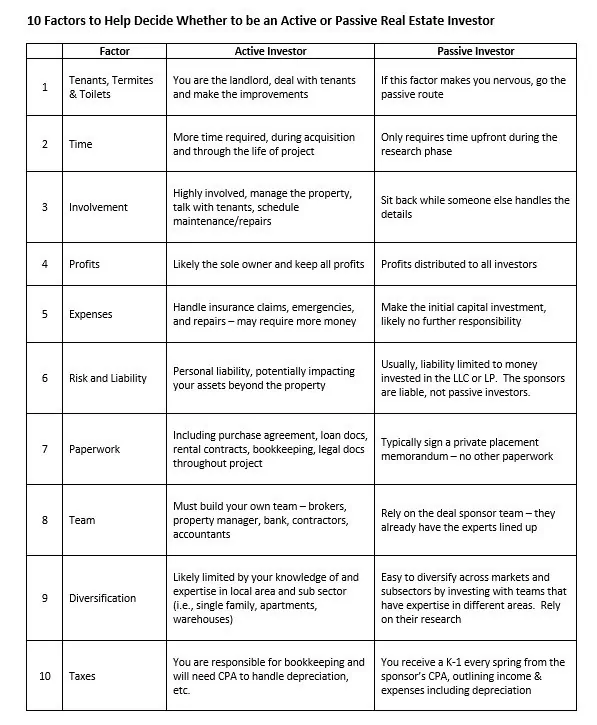

In this article, you’ll see the differences between being an active or a passive real estate investor to help guide you in investing your hard-earned money.

What it means to be an active investor

Most people think of buying a single-family home, finding a renter, and collecting monthly rent from the tenant. That sounds easy enough, but the reality of life as a landlord can be quite different.

Even if you hire a professional property manager, you as the landlord are actively involved in the investment. Yes, the property manager handles day-to-day issues, but you will still be involved in strategic decisions. Whether to evict non-paying tenants, file insurance claims when there are losses, negotiate with the bank, and make additional cash investments to cover unexpected maintenance or repair costs.

What it means to be a passive investor

On the other hand, passive investing in real estate is a bit of a “fire and forget” approach. You invest your money and somebody else generally called a “sponsor” does all of the heavy liftings.

The great thing about passive investing is…well, it’s totally passive. There are no calls from the property manager or the tenants, no talking to the bank, the insurance company, and there is minimal paperwork.

The tradeoff with passive investing is you will relinquish some of the control to the sponsor that you otherwise would have. You trust someone else to manage the property and execute the plan on your behalf.

Active Versus Passive Real Estate Investing: Conclusion

If you are motivated to roll your sleeves up and tackle all of the various aspects of being a landlord, active real estate investing may be the perfect fit for you.

However, if you are slammed for time, are all thumbs, and have the capital to invest, it may be wise to consider passive real estate investing.

When determining the right path for you and your family, make sure to take into account your unique situation, goals, interests, and aptitude – rarely is there one size fits all.

To learn more about diversifying your portfolio by investing in real estate join our list to receive monthly communication from Prevail Innovative Real Estate Opportunities here or don’t hesitate to contact us today.