Prevail’s Mission: Disrupt the financial services industry by creating awareness of the uncontrollable factors that can impede financial stability while mitigating potential financial headwinds. Come experience what other firms “say” they do.

Prevail Strategies was established in 2017 after more than 30 years of experience as a traditional investment advisory firm. Over those 30 years, we’d seen that money management had become a commodity – with many financial Investment Advisor Representatives offering similar products and strategies, just packaged in different ways.

Prevail is different. We don’t seek to compete with traditional financial advice, we strive to modernize and enhance it. Our strategies require clients to engage in a planning process with the ultimate goal of them taking control of their financial future.

For our entire team, we provide the opportunity to be a part of something special. A team that challenges the status quo, and is interested in changing an industry while providing a meaningful service for others. Specifically for Investment Advisors Representative, it’s an opportunity to build something significant that produces real results for their clients. You’ll be working with a firm steeped in experience that places a high value on people, integrity, and making a difference in the lives of those around us.

Interested? Watch our video below and contact Marcia Vander Wal for more information.

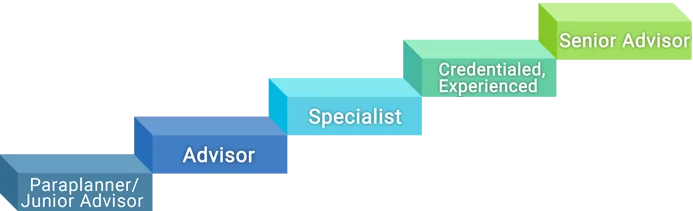

Experience a rewarding profession with room for growth, competitive pay, and perks second to none.

If you have a passion for helping others, choose a profession where you can make a difference helping clients achieve results.

Work in a collaborative environment to achieve and accomplish our vision. Benefit from having the independence to grow with our dynamic team and achieve your goals.

Investment Philosophy – Volatility is here to stay.

Investment Philosophy – Volatility is here to stay.

We use it as an advantage to portfolios vs. being a victim of volatility. With active portfolio management over 12 in-house strategies, our clients experienced significantly improved results vs. peers groups.

Diversification – Non-correlated assets enhance portfolio construction and provide better wealth creation.

The use of private real estate, high cash value life insurance, and other alternatives to provide a more holistic portfolio construction.

Diversification – Non-correlated assets enhance portfolio construction and provide better wealth creation.

The use of private real estate, high cash value life insurance, and other alternatives to provide a more holistic portfolio construction.  Tax Strategies – While reducing taxes today is important, having options and transitioning assets into a tax-free environment for retirement and legacy planning is critical and a strategy missed by most Advisors.

Tax Strategies – While reducing taxes today is important, having options and transitioning assets into a tax-free environment for retirement and legacy planning is critical and a strategy missed by most Advisors.

Passive Income – Whether it’s in portfolio construction or individual strategies, income producing portfolios reduce volatility and smooth out the client experience. Selling assets at a loss to produce income never bodes well.

Passive Income – Whether it’s in portfolio construction or individual strategies, income producing portfolios reduce volatility and smooth out the client experience. Selling assets at a loss to produce income never bodes well.

Have you had a successful career, but feel unfulfilled, underappreciated, or tired of the corporate rat race? If so, a career with Prevail may be your answer.

Prevail continues to challenge the status quo in the financial services industry. Our unique approach is tailored to high-net worth clients to whom we deliver comprehensive wealth creation and management strategies in a team-based environment.

There are three key reasons you may consider this move:

1. If you have a strong desire to help others achieve financial security and success, Prevail delivers.

2. At Prevail you have the opportunity to build a business of significance. As you build a solid client base and gain experience, you are directly rewarded for your efforts. As your clients win, so do you.

3. The role is ever-changing. As financial landscapes evolve, so does Prevail and its advisors. You will be challenged on a regular basis to provide innovative solutions that differentiate our services from the commoditization of the financial industry.

Think you may be a good fit for our growing organization? Call us today to set a time to meet with our executive team and see if our values align. Unlike other “big-box” firms in our industry, we don’t hire every person who walks in our door. We value our amazing culture and protect it. Our in-depth interview process will help us to determine if this change is right for both of us.

Prevail provides a “plug-n-play” business model where Advisors can utilize a pre-built infrastructure to foster and grow their individual businesses.

Our approach to clients involves:

Our approach to clients involves:

Prevail U – Quarterly Prevail University

Prevail U – Quarterly Prevail University

Client Events

Client Events

Marketing Program

Marketing Program

Coaching and Mentoring

Coaching and Mentoring

Our Culture

Our Culture

Prevail operates from a foundation of values and faith with an emphasis on quality of life for our community, our clients, and our staff. Our Values include: Integrity, Passion, Loyalty, Teamwork, and Creativity.

Be faithful and diligent with the investments and responsibilities we have been given.

Every person has dignity and worth regardless of status or company affiliation.

Don’t be arrogant; much of our success is rooted outside ourselves.

Take ownership of fixing the problem, not placing the blame.

Individual successes only count if they make the team and the company successful also.

Resolve issues with the other person honestly and directly, while always seeking their good.

At Prevail, managing money is more than financial. It’s personal. And it’s personalized. We never use a cookie-cutter approach. Every client is different, and so must be their approach to creating, growing, protecting, and distributing their wealth. The “model portfolio” where money is stacked in different funds (ex. conservative, balanced, value, growth, aggressive growth, etc.) isn’t necessarily a model for today. Today’s market is unique, and so are the needs of our clients. Since the economy, the world, and our individual situations can change at a break-neck speed, Prevail takes into account not only our clients’ risk tolerance and asset class diversification, but also their overall tax strategy—that layers in another level of protection of assets.

Active and strategic management.

Our portfolios are built from stocks that we have researched, analyzed, tracked, forecasted, and tested. The strategic plan for how to leverage these investments is custom-built for every client. In other words, we have flipped the typical business model on its head. Instead of employing a large number of RIAs (Registered Investment Investment Advisors Representative) to accumulate AUM (Assets Under Management), we’ve poured our resources into technical analysis to generate wealth creating opportunities for our clients. This provides our team with tremendous opportunities to help clients limit downside exposure in market downturns and maximize upside during positive trends.

We Have Some Answers

Quam elementum pulvinar etiam non. Nibh praesent tristique magna sit amet purus. Augue lacus viverra vitae congue eu. Bibendum est ultricies integer quis auctor elit sed. Tortor pretium viverra suspendisse potenti nullam ac tortor. Viverra orci sagittis eu volutpat odio facilisis mauris sit amet. Consectetur a erat nam at lectus urna. Senectus et netus et malesuada fames. Tincidunt arcu non sodales neque sodales ut. Nibh praesent tristique magna sit amet purus gravida quis. Ultrices neque ornare aenean euismod elementum nisi quis. Potenti nullam ac tortor vitae purus faucibus ornare suspendisse. Velit egestas dui id ornare arcu odio ut sem. Amet nisl suscipit adipiscing bibendum est ultricies integer quis auctor. Enim sit amet venenatis urna. Nunc sed blandit libero volutpat sed cras ornare arcu. Pellentesque dignissim enim sit amet venenatis urna.

Quam elementum pulvinar etiam non. Nibh praesent tristique magna sit amet purus. Augue lacus viverra vitae congue eu. Bibendum est ultricies integer quis auctor elit sed. Tortor pretium viverra suspendisse potenti nullam ac tortor. Viverra orci sagittis eu volutpat odio facilisis mauris sit amet. Consectetur a erat nam at lectus urna. Senectus et netus et malesuada fames. Tincidunt arcu non sodales neque sodales ut. Nibh praesent tristique magna sit amet purus gravida quis. Ultrices neque ornare aenean euismod elementum nisi quis. Potenti nullam ac tortor vitae purus faucibus ornare suspendisse. Velit egestas dui id ornare arcu odio ut sem. Amet nisl suscipit adipiscing bibendum est ultricies integer quis auctor. Enim sit amet venenatis urna. Nunc sed blandit libero volutpat sed cras ornare arcu. Pellentesque dignissim enim sit amet venenatis urna.

Quam elementum pulvinar etiam non. Nibh praesent tristique magna sit amet purus. Augue lacus viverra vitae congue eu. Bibendum est ultricies integer quis auctor elit sed. Tortor pretium viverra suspendisse potenti nullam ac tortor. Viverra orci sagittis eu volutpat odio facilisis mauris sit amet. Consectetur a erat nam at lectus urna. Senectus et netus et malesuada fames. Tincidunt arcu non sodales neque sodales ut. Nibh praesent tristique magna sit amet purus gravida quis. Ultrices neque ornare aenean euismod elementum nisi quis. Potenti nullam ac tortor vitae purus faucibus ornare suspendisse. Velit egestas dui id ornare arcu odio ut sem. Amet nisl suscipit adipiscing bibendum est ultricies integer quis auctor. Enim sit amet venenatis urna. Nunc sed blandit libero volutpat sed cras ornare arcu. Pellentesque dignissim enim sit amet venenatis urna.

Download Prevail’s Intro Guide To Personal Wealth Risk Management.

10 Ways to MInimize Risk & Maximize Asset Protection

At Prevail, managing money is more than financial. It’s personal. And it’s personalized. We never use a cookie cutter approach. Every client is different and so must be their approach to creating, growing, protecting, and distributing their wealth. The “model portfolio” where money is stacked in different funds (ex. conservative, balanced, value, growth, aggressive growth, etc.) isn’t necessarily a model for today. Today’s market is unique. And so are the needs of our clients. Since the economy, the world, and our individual situations can change at a break-neck speed, Prevail takes into account not only our clients’ risk tolerance and asset class diversification, but also their overall tax strategy—that layers in another level of protection of assets.

Active and strategic management.

Our portfolios are built from stocks that we have researched, analyzed, tracked, forecasted and tested And the strategic plan for how to leverage these investments is custom built for every client. In other words, we have flipped the typical business model on its head. Instead of employing a large number of RIAs (Registered Investment Investment Advisors Representative) to accumulate AUM (Assets Under Management), we’ve poured our resources into technical analysis to generate wealth creating opportunities for our clients. This provides our team with tremendous opportunities to help clients limit downside exposure in market down turns, and maximize upside during positive trends.

Preserve, Protect, and Perpetuate your Wealth

Summer Hours

Company Info

Careers

Strategies / Services

Careers

Summer Hours

Strategies / Services

Careers

When accessing prevailiws.com, please be advised that this website engages in the collection and processing of various types of data from visitors. This includes, but is not limited to, the use of cookies to monitor and track browsing activities, as well as the collection of personally identifiable information (PII) such as phone numbers, email addresses, physical addresses, and IP addresses. By using this website, you consent to the collection and use of this information as outlined in the website’s privacy policy. It is recommended that you review the privacy policy thoroughly to understand how your data may be utilized, stored, and shared. If you have concerns about your privacy, consider using tools and practices that enhance your online security.

Prevail

The website has several strategies and topics discussed throughout the content. It is important for prospective clients and website visitors to know there are different entities that offer specific levels of advice, support, or guidance. Fixed insurance products and services are offered through Prevail Strategies, LLC, a licensed insurance agency. Prevail Innovative Real Estate Opportunities, LLC a propriety real estate division. Prevail Innovative Wealth Advisors, LLC, Prevail Innovative Real Estate Opportunities, LLC and Prevail Strategies, LLC have common ownership and control.

© 2024 Prevail Strategies. All Rights Reserved.

web services by: kcwebdesigner.com | kcseopro.com