Building wealth through real estate is a timeless dream for many, but navigating the options can feel like a game of chance. Enter the two titans of the real estate investment arena: Real Estate Investment Trusts (REITs) and individual deals. Each offers unique paths to riches, but understanding the differences is key to unlocking your financial potential.

REITs: The Passive Income Powerhouse

Imagine pooling your money with others to buy a whole shopping mall, a bustling office building, or a sprawling apartment complex. That’s the benefits of REITs. These companies own, operate, or finance diverse real estate assets, allowing you to invest like a tycoon without the hassle.

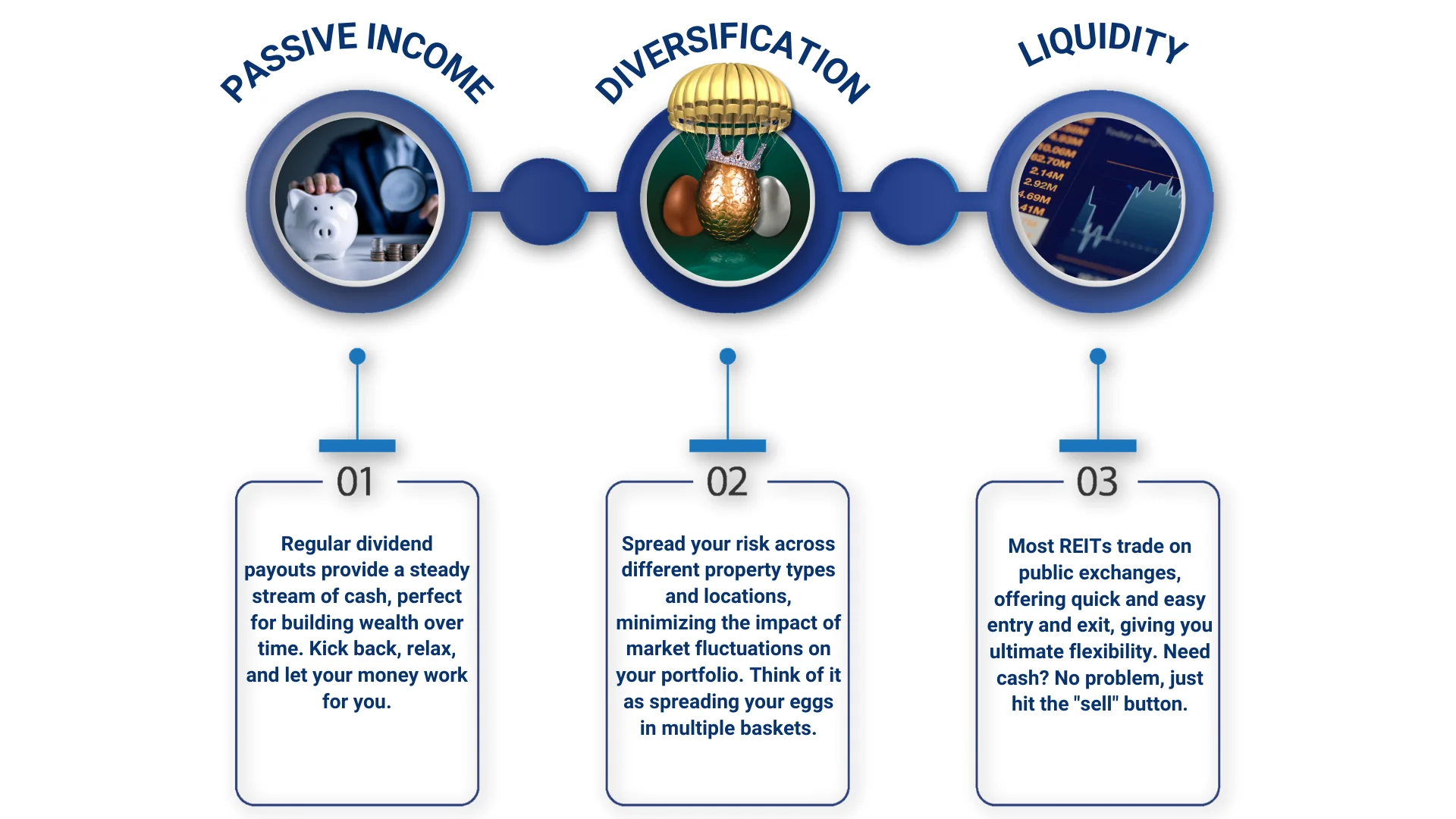

Here’s why REITs could be a key opportunity for you:

But don’t get too comfy in your hammock just yet. REITs come with their own set of limitations:

- Limited control: You hand the reins to the REIT managers, trusting their choices for investments and property management. Hope you like their taste!

- Lower potential returns: While offering reliable income, REITs typically experience slower growth compared to individual deals, meaning your riches might accumulate at a slower pace.

- Market sensitivity: REITs can be susceptible to economic and sector-specific factors, so your income and investment value can fluctuate. Buckle up for the occasional bumpy ride.

Individual Deals: The Hands-On Hustle

Crave the thrill of the deal? Individual real estate investments offer a more active approach, letting you roll up your sleeves and delve into the nitty-gritty.

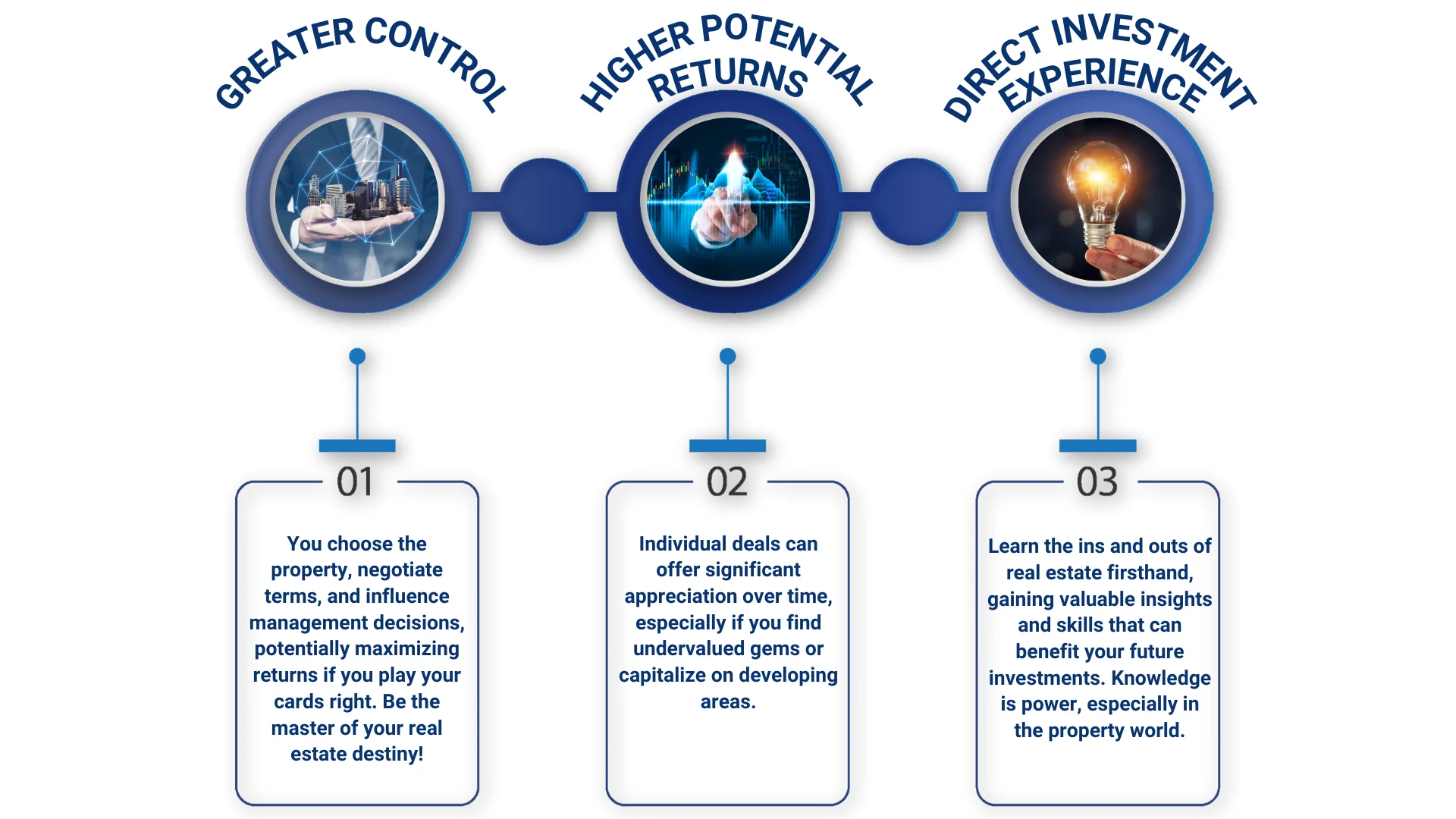

Why dive into individual deals? Consider these advantages:

However, individual deals come with their own set of challenges:

- Illiquidity: Buying and selling properties takes time and effort, with less flexibility compared to REITs. Think of it as a marathon, not a sprint.

- Higher risk: Individual deals carry greater risk due to tenant issues, repairs, and market downturns. Do your due diligence and prepare for potential bumps along the road.

- Time commitment: Managing a property requires time and dedication, from finding tenants to handling maintenance. Be prepared to get your hands dirty!

Choosing Your Path to Wealthy Acres

Ultimately, the best path depends on your individual goals and risk tolerance. Ask yourself:

- Do I prioritize passive income or potential for explosive growth?

- Am I comfortable with a hands-on approach or prefer a more laid-back strategy?

- How much risk can I stomach?

Prevail: Your Off-Market Gateway to Real Estate Opportunities

While REITs and individual deals offer distinct avenues, Prevail provides alternative assets, such as real estate strategies (only available to qualified or accredited investors), with off-market opportunities. Forget generic funds and cookie-cutter choices. We delve into niche sectors, meticulously analyzing untapped potential in emerging markets, undervalued properties, and unique asset classes. This targeted approach delivers:

Investing in off-market real estate isn’t for everyone. It requires a specific risk appetite and a willingness to explore beyond the usual suspects. But for those seeking high-growth potential, unparalleled diversification, and active engagement in the investment process, Prevail offers a great opportunity to unlock real estate assets.

Ready to venture beyond the ordinary? Contact Prevail today and discover the true power of off-market real estate.

Consulting with experienced financial advisors like our team at Prevail Strategies can help you analyze your situation, identify your risk tolerance, and develop a personalized investment plan. Remember, diversification is key, and a well-balanced portfolio can unlock the doors to your real estate dreams.

Email: riseabove@prevailiws.com

Phone: 913-295-9500

careeratprevail.com