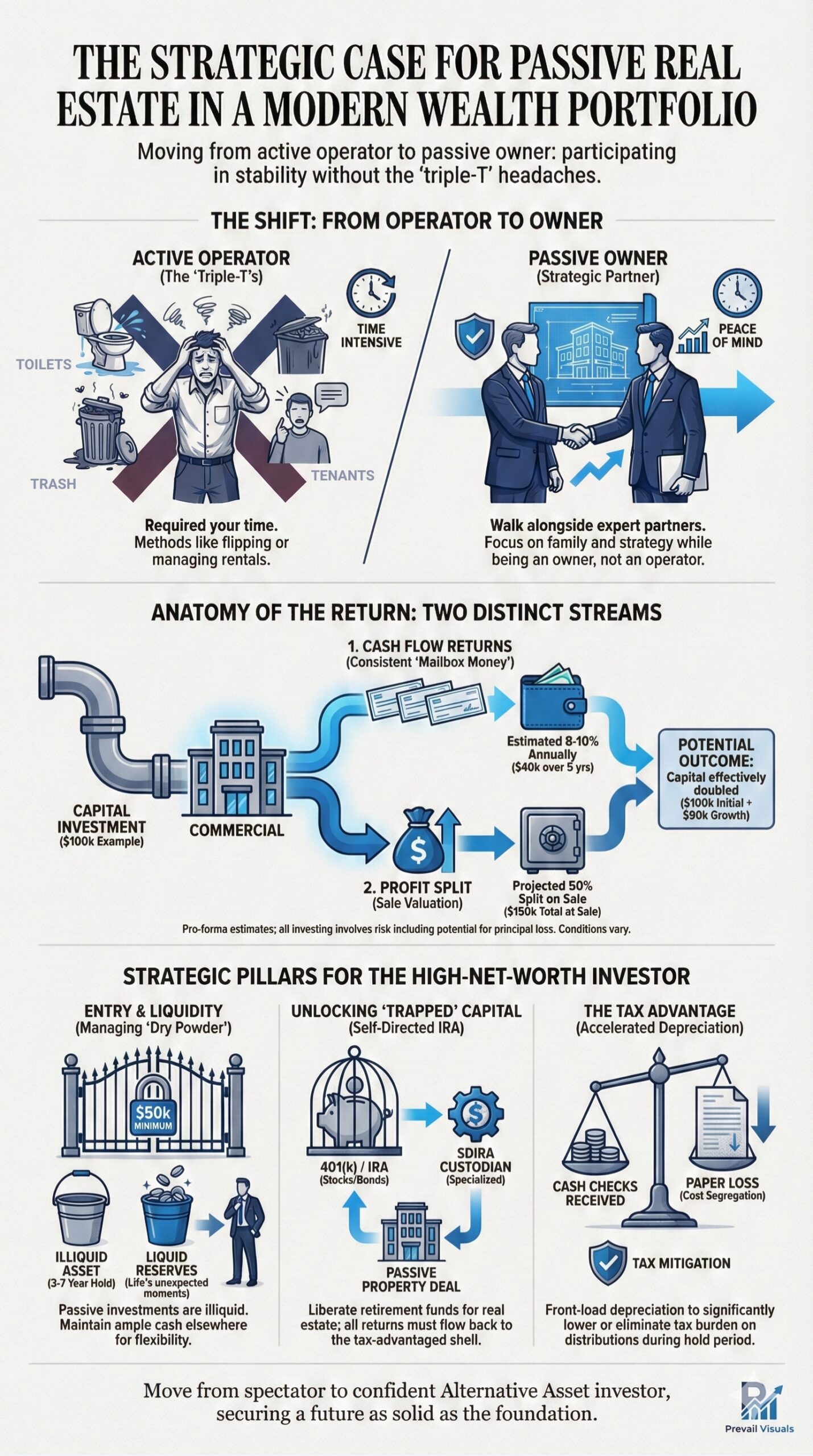

If you could participate in the stability of commercial real estate without the "triple-T" headaches of tenants, toilets, and trash, why would you continue to settle for the volatility of a purely public portfolio? For the high-net-worth family, real estate has always been the bedrock of legacy.

You likely remember a grandfather who held a few rental doors or a father who spent his weekends flipping houses for a profit. While those methods built wealth, they required something more valuable than money: your time. Today, the elite market is shifting toward a more sophisticated, "human-centric" approach—passive real estate investing.

It’s about being an owner without being an operator, allowing you to walk alongside expert partners while you focus on what truly matters: your family and your peace of mind.

When you transition to passive property ownership, you aren't just buying a "stock" that might go up or down; you are acquiring a stake in a physical, income-producing asset. This creates two distinct streams of wealth.

First, there are the cash flow returns—the consistent monthly or quarterly checks that provide immediate "mailbox money" for your lifestyle. Second, there is the profit split, realized when the property is eventually sold at a higher valuation.

Imagine a $100,000 investment. Over a five-year horizon, you might see 8-10% in annual cash flow, totaling $40,000. Upon the sale of the asset, a 50% profit split could return your initial $100,000 plus an additional $50,000. In this narrative, your capital has effectively doubled.

However, it is important to remember that all investing involves risk, including the potential loss of principal. The strategies discussed are designed for accredited investors and are based on pro-forma estimates; actual results may vary depending on market conditions, execution, and underlying asset performance. Working with a Strategic Wealth Partner provides professional guidance to evaluate these factors within the context of your broader financial strategy before allocating capital.

Passive real estate is a specialized arena, typically requiring a minimum investment of $50,000. Because these investments are "illiquid"—meaning your capital is committed until the property is sold—it is vital to maintain a healthy cash position elsewhere.

This is where Liquidity Management becomes paramount. We often help clients structure their holdings so they have ample "dry powder" for life’s unexpected moments while their "legacy capital" works hard in the background of a private real estate deal.

One of the most overlooked strategies for HNWIs is the use of retirement funds for real estate. Most people believe their 401(k) or IRA is restricted to mutual funds and bonds.

By utilizing a Self-Directed IRA (SDIRA), you can liberate those "trapped" dollars and deploy them into passive property deals. The process requires precision: the funds must move from your current custodian to a specialized SDIRA company, and all returns must flow back into that tax-advantaged shell.

When executed correctly, this allows you to grow your retirement nest egg with the stability of brick-and-mortar assets rather than the whims of a chaotic stock market.

The true "secret weapon" of the wealthy isn't just the return on the investment; it’s what you keep after Uncle Sam takes his share. Through Tax Mitigation strategies like cost segregation, we can front-load the depreciation of a building into the first few years of ownership.

This "paper loss" can often offset the actual cash checks you receive, significantly lowering—or even eliminating—the tax burden on your distributions during the hold period. It is a sophisticated way to gain control over your tax future while building a multi-generational estate via specialized asset protection.

Real estate is more than just an asset class; it is a hedge against the noise of the world. By understanding these technical pillars, you move from being a spectator to a confident Alternative Asset investor, securing a future that is as solid as the foundations of the properties you own.

What is a "Profit Split" in a passive deal? It is the distribution of gains realized upon the sale of a property. After the initial capital is returned to investors, the remaining profit is split between the limited partners (you) and the general partners (the sponsors) based on a pre-agreed percentage.

Can I withdraw my money early if I need it? Generally, no. Passive real estate investments are illiquid with a defined "hold period," often 3 to 7 years. This is why professional consultation is critical to ensure you have sufficient liquid reserves before investing.

How does a Self-Directed IRA work with real estate? An SDIRA allows you to invest in non-traditional assets. You must use a specialized custodian who handles the legal paperwork and ensures that all income and expenses stay within the IRA to maintain its tax-deferred status.

Is my investment guaranteed? No investment is without risk. While real estate is a tangible asset, factors like occupancy rates, interest rates, and local economic shifts can impact returns. Diversifying across different property types is a common strategy to mitigate these risks.

#PassiveIncome #RealEstateInvesting #TaxStrategy #SDIRA #WealthCreation #KansasCityMO #OverlandParkKS #KCMO #KansasCityFinance #OverlandParkWealth

Request a professional consultation to evaluate your passive real estate opportunities.

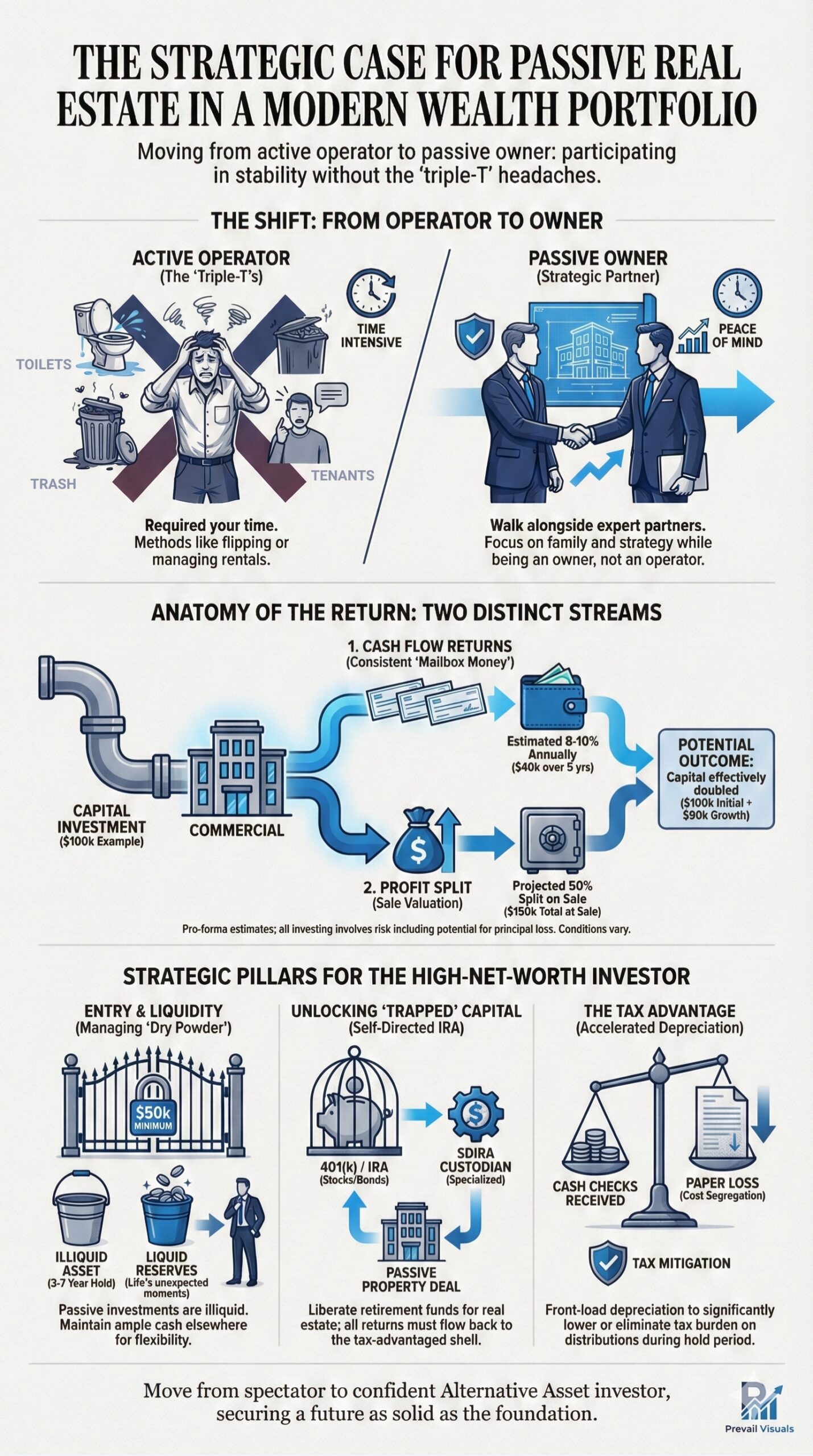

If you could participate in the stability of commercial real estate without the "triple-T" headaches of tenants, toilets, and trash, why would you continue to settle for the volatility of a purely public portfolio? For the high-net-worth family, real estate has always been the bedrock of legacy.

You likely remember a grandfather who held a few rental doors or a father who spent his weekends flipping houses for a profit. While those methods built wealth, they required something more valuable than money: your time. Today, the elite market is shifting toward a more sophisticated, "human-centric" approach—passive real estate investing.

It’s about being an owner without being an operator, allowing you to walk alongside expert partners while you focus on what truly matters: your family and your peace of mind.

When you transition to passive property ownership, you aren't just buying a "stock" that might go up or down; you are acquiring a stake in a physical, income-producing asset. This creates two distinct streams of wealth.

First, there are the cash flow returns—the consistent monthly or quarterly checks that provide immediate "mailbox money" for your lifestyle. Second, there is the profit split, realized when the property is eventually sold at a higher valuation.

Imagine a $100,000 investment. Over a five-year horizon, you might see 8-10% in annual cash flow, totaling $40,000. Upon the sale of the asset, a 50% profit split could return your initial $100,000 plus an additional $50,000. In this narrative, your capital has effectively doubled.

However, it is important to remember that all investing involves risk, including the potential loss of principal. The strategies discussed are designed for accredited investors and are based on pro-forma estimates; actual results may vary depending on market conditions, execution, and underlying asset performance. Working with a Strategic Wealth Partner provides professional guidance to evaluate these factors within the context of your broader financial strategy before allocating capital.

Passive real estate is a specialized arena, typically requiring a minimum investment of $50,000. Because these investments are "illiquid"—meaning your capital is committed until the property is sold—it is vital to maintain a healthy cash position elsewhere.

This is where Liquidity Management becomes paramount. We often help clients structure their holdings so they have ample "dry powder" for life’s unexpected moments while their "legacy capital" works hard in the background of a private real estate deal.

One of the most overlooked strategies for HNWIs is the use of retirement funds for real estate. Most people believe their 401(k) or IRA is restricted to mutual funds and bonds.

By utilizing a Self-Directed IRA (SDIRA), you can liberate those "trapped" dollars and deploy them into passive property deals. The process requires precision: the funds must move from your current custodian to a specialized SDIRA company, and all returns must flow back into that tax-advantaged shell.

When executed correctly, this allows you to grow your retirement nest egg with the stability of brick-and-mortar assets rather than the whims of a chaotic stock market.

The true "secret weapon" of the wealthy isn't just the return on the investment; it’s what you keep after Uncle Sam takes his share. Through Tax Mitigation strategies like cost segregation, we can front-load the depreciation of a building into the first few years of ownership.

This "paper loss" can often offset the actual cash checks you receive, significantly lowering—or even eliminating—the tax burden on your distributions during the hold period. It is a sophisticated way to gain control over your tax future while building a multi-generational estate utilizing tailored asset strategies.

Real estate is more than just an asset class; it is a hedge against the noise of the world. By understanding these technical pillars, you move from being a spectator to a confident Alternative Asset investor, securing a future that is as solid as the foundations of the properties you own.

What is a "Profit Split" in a passive deal? It is the distribution of gains realized upon the sale of a property. After the initial capital is returned to investors, the remaining profit is split between the limited partners (you) and the general partners (the sponsors) based on a pre-agreed percentage.

Can I withdraw my money early if I need it? Generally, no. Passive real estate investments are illiquid with a defined "hold period," often 3 to 7 years. This is why professional consultation is critical to ensure you have sufficient liquid reserves before investing.

How does a Self-Directed IRA work with real estate? An SDIRA allows you to invest in non-traditional assets. You must use a specialized custodian who handles the legal paperwork and ensures that all income and expenses stay within the IRA to maintain its tax-deferred status.

Is my investment guaranteed? No investment is without risk. While real estate is a tangible asset, factors like occupancy rates, interest rates, and local economic shifts can impact returns. Diversifying across different property types is a common strategy to mitigate these risks.

#PassiveIncome #RealEstateInvesting #TaxStrategy #SDIRA #WealthCreation #KansasCityMO #OverlandParkKS #KCMO #KansasCityFinance #OverlandParkWealth