With markets caught in a volatile pattern of selloffs and rallies, we thought we would do a quick round-up of what we know (very little) and don’t (a lot).

Before we begin, we should say: if you’re looking for hope, you can find it here. From where the stock market stands, the crystal ball looks murky: but we approach situations like this as an opportunity even though the economic data strategists rely on is confusing, complex, and contradictory.

How likely is a recession?

We’ve already seen two negative quarters of GDP growth – that’s the technical definition of a recession.1

However, the official arbiter of recessions, the National Bureau of Economic Research (NBER), hasn’t made the call yet because they’re waiting to see how long and how widespread the current dip in growth is.

There are real risks of a recession all around us, but the overall picture is a mixed bag of positive and negative.2

On the positive side: The labor market has defied gravity and is still creating plenty of new jobs. Consumer spending is also looking healthy.

On the negative side: Persistent inflation is obviously on everyone’s radar, as are the Fed’s aggressive interest rate hikes.

As the economy recovers from all the distortions of pandemic lockdowns, federal spending, supply chain snarls, and policy changes, it seems hard to believe that we could avoid a recession.

So let’s be calm, ready, and flexible.

Are interest rates going to go higher?

That seems likely, yes.

Despite the optimism of individuals who hope for a loosening of hikes, the Fed’s monetary policy is likely going to continue tightening (and stay tight) to bring down inflation and keep it down.

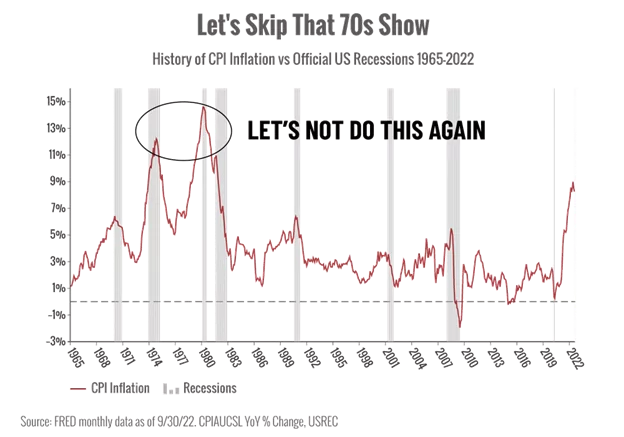

Slacking interest rates too soon could lead to the lingering inflation problems of the 1970s, which I think Fed policymakers want to avoid.

With the benefit of hindsight, we know that a key contributor to the persistently high inflation in the mid-to-late 70s was the Fed’s choice not to aggressively raise interest rates (to avoid triggering a recession).3

Unfortunately, that timid approach ended up failing.

The interest rate shock treatment a new Fed chair imposed in the early 80s triggered multiple painful recessions in the pursuit of low inflation.

It doesn’t seem likely that we’ll see the same situation today.

Why? The Fed’s attitude is quite different, the economy is structurally different, and economists are much more aware of the delicate balance they must strike.

Have we seen the bottom of the market yet?

That’s hard to say. Historically, the fourth quarter has been positive for market performance.4

However, we all know that the past can’t predict the future, and there’s a lot of uncertainty on the horizon.

We’ve got inflation and interest rate worries, midterm elections, a war in Ukraine, and energy price concerns.

However, we’ve seen that investors are eager to be optimistic, so we can expect rallies when positive news hits.

Timing market tops or bottoms almost never works. What works is being in the market when it moves.

Bottom line: Let’s not focus on timing. Let’s focus on sticking to the strategies we’ve set so we can see the upside when it comes.

With all the recent news, we can be forgiven for thinking that things are a mess. That everything’s bad or getting worse.

If you feel that way, you’re not alone. A lot of people feel that way.

We’re human. We live our lives one day at a time inside a fairly small bubble. And that bubble is easily influenced by daily hassles, headlines, and our own mindset.

And we’ve made it through.

Maybe a little older, a little wiser, and a little more cautious.

We’re not alone in this. We have you and you have us. We’ll take it one step at a time.

We’re watching, We’re strategizing, and we’ll reach out as needed.

Before we go, we’d like to close with a challenge for all of us.

What are you grateful for right now? What’s good and beautiful about your life and the people around you?

1 – https://www.foxbusiness.com/economy/us-economy-shrank-second-quarter-entering-technical-recession

2 – https://economics.td.com/us-quarterly-economic-forecast

3 – https://www.schwab.com/learn/story/is-1970s-style-inflation-coming-back

4 – https://www.cnn.com/2022/10/03/investing/premarket-trading-stocks/index.html

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Investment Advisory services are offered through Prevail Innovative Wealth Advisors, LLC, a federally registered investment advisor. Registration with any securities authority is not an endorsement of the services offered by the investment adviser. Fixed insurance products and services are offered through Prevail Strategies, LLC, a licensed insurance agency. A client may receive investment advice in addition to fixed insurance recommendations as a part of the financial planning process. Prevail Innovative Wealth Advisors, LLC and Prevail Strategies LLC have common ownership. Prevail Innovative Wealth Advisors, LLC and Prevail Strategies LLC do not provide tax or legal advice. You should always consult your CPA or tax professional for decisions involving tax implications present and future.

For a copy of Prevail Innovative Wealth Advisors Privacy Policy, Disclosure Brochure (Form ADV Part 2A), or Client Relationship Summary (Form ADV Part 3), please contact your Investment Adviser Representative or call our main office at (913) 295-9500.