Written By: Prevail Strategies

Prevail Innovative Wealth Advisors is pleased to bring you our monthly newsletter. In each edition, we discuss various investment-related topics, including market conditions, economy, policy, portfolio management, and other external forces.

This month, we want to talk about risk in the markets. The world feels a little shaky right now, but we’re here to remind you that markets (and people) tend to overreact to unfortunate events that usually don’t have any large material effects. Despite this, being in the markets during times like this can feel stressful.

Should you have any questions regarding this information, or if you would like to discuss your risk tolerance or investment objective, please contact a Prevail Innovative Wealth Advisor Representative, or call our main office at (913) 295-9500.

Summary Overview

Everyone who follows the trend of economic news already expected March to be a busy month, but it has certainly exceeded our expectations for market-moving headlines. A highly anticipated Federal Reserve meeting where the first policy rate hike is expected to be announced, the ongoing conflict between Russia and Ukraine, and various economic reports like the CPI Index Summary have been battling in the forefront of investors’ minds – all these topics are inextricably linked together.

Fed Decision and Inflation

The Federal Reserve is set to have their policy rate liftoff at their March meeting this week. The March CPI Index Summary came in at a 7.9% increase year-over-year; still very hot when many economists predicted that inflation would begin to peak in February. Recent geopolitical events have erased any chances of seeing a 50bps rate hike this month (consensus is a 25bps rate increase, which Fed Chair Jerome Powell is on testimony record as endorsing), but the market is still pricing in 7 rate hikes this year – one for every Fed meeting.

Update on Ukraine Conflict

It is difficult to grasp just how critical daily government leadership decisions will be on the global economy and the impact they will have on the world long-term. The situation in Ukraine is so fluid, it seems impossible to keep up with every update. The important takeaway is that if NATO gets pulled into the conflict, then that means the US will be pulled in. Many Russian threats are being levied toward Baltic States and immediate members of NATO that surround Ukraine.

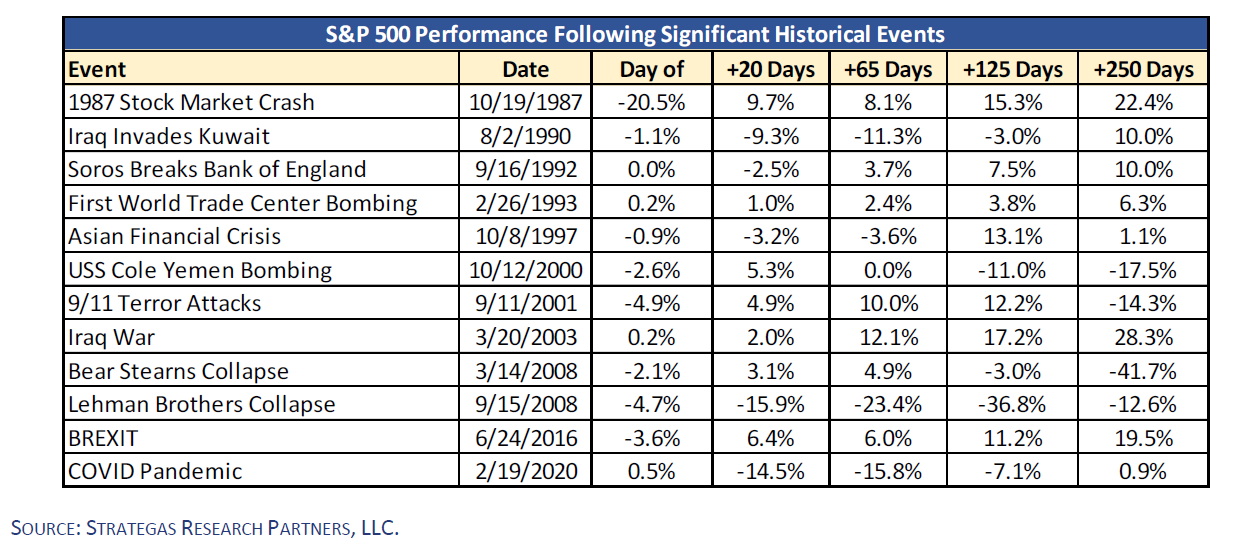

It’s more important to acknowledge the performance of the economy and the general market than to get caught up in what geopolitical tensions may mean. Those tensions usually don’t matter much as far as stocks are concerned. The table below is a great example of how conflict impacts the market short-term but is usually just a blip on the radar over the long term.

You can see from the table – even though it is a small sample size – that the S&P 500 is flat-to-positive 67% of the time 65 days after a crisis and it is positive 75% of the time after 250 days. This is just a roundabout way to say that short-term market fluctuations very rarely matter over the long term.

It’s stressful to see any kind of conflict in the world. You have every right to be concerned, sad, angry, and every emotion in between. But don’t let those emotions ruin a well-thought-out investment plan – especially when there is little evidence that those events have any long-term material effect on the markets.

Items of Interest

- Nations that don’t usually buy crops from the US have become buyers of domestic grains because of potential crop shortages caused by the Russia/Ukraine conflict

- There were a reported 72 cargo ships backlogged off the coast of China because of lockdowns as Omicron has spread through China

- Residential investment has begun to soften year-over-year after tremendous spending initially brought on by the onset of the pandemic

- Analysts indicate that energy costs account for nearly 70% of current inflation readings – the good news is that energy producers are capable of meeting current demand, which will allow prices to come back down

What We’re Doing

A volatile market is difficult to navigate, make no doubt about it. Our Investment Advisory Committee (IAC) – which meets weekly to adjust our portfolios – has started by shifting a larger portion of our allocation to cash to be more defensive. The IAC has also decided to increase turnover in our portfolios by trimming position sizes and opting to take smaller gains on winners where possible.

The IAC has increased exposure to depressed sectors that we believe have bottomed and are primed for future performance including financials, consumer staples, and commodity positions that we’re watching closely. We know this market is moving fast and no one can predict where it will be in even a week’s time. Our focus is on preserving capital and watching areas of the market that have shown resilience amid the turmoil.

Disclosure

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with investment & tax professionals before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international-based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests, and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange-traded funds, preferred stocks, rights, warrants, units, and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

The MSCI EAFE Index is an equity index that captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Year To Date Prevail Performance Returns are estimated from using end-of-month performance from select client statements. The returns are not audited and do not indicate performance for all clients invested in one of these portfolios. Timing of market entry will affect client returns and not all clients will experience the estimated returns listed above. Returns do not indicate future performance.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities.

Advisory services are offered through Prevail Innovative Wealth Advisors, LLC, a Registered Investment Adviser registered with the State of Missouri, Kansas, and Texas. Registration does not imply a certain level or skill or training. More information about the registered investment advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling 913295-9500. Prevail Innovative Wealth Advisors, LLC