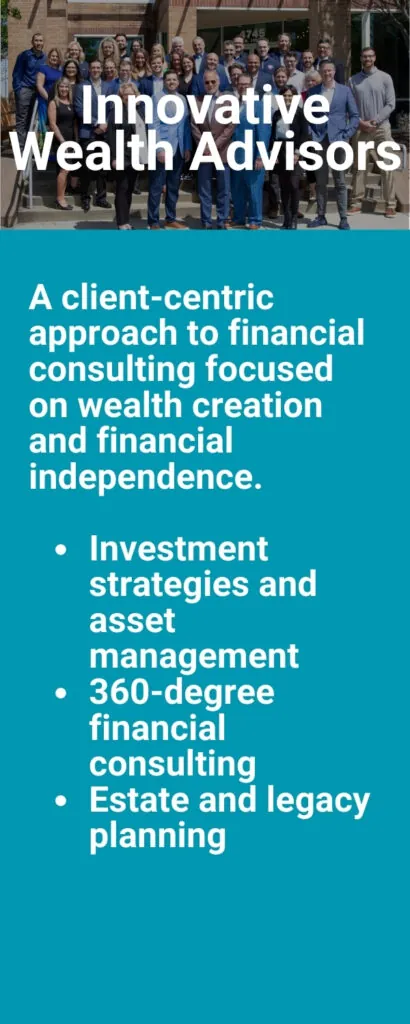

Discover how Prevail Innovative Wealth Strategies uses a Financial Board of Directors approach to deliver advanced planning, seamless collaboration, and tailored strategies for building, protecting, and transferring wealth.

Significant wealth demands more than a single perspective. At Prevail Innovative Wealth Investment Advisors, we surround every client with a Financial Board of Directors—a coordinated team of specialists working in unison to protect, grow, and optimize your wealth across every stage of life.

This model mirrors the level of oversight found in successful corporations, but is personalized to align with your life, goals, and vision for the future. The result? Strategies that are both comprehensive and precise—built to withstand market shifts, changing tax laws, and evolving family needs.

The Power of a Team, Aligned for You

Many financial firms claim to have a “team approach,” but in reality, specialists often work independently in their own silos. That separation can lead to missed opportunities, duplicated efforts, and unintended tax or legal consequences.

At Prevail, your Financial Board of Directors works as a single, coordinated unit—bringing together investment management, tax strategy, estate planning, risk management, and liquidity planning into one seamless plan. Every voice at the table offers a unique vantage point, ensuring that your strategy is not only balanced, but also resilient.

Why One Advisor Isn’t Enough

A single advisor can be talented and dedicated—but no one can master every discipline. With a financial board, you gain access to multiple professionals with deep expertise in their fields.

If one advisor doesn’t see a potential risk or opportunity, another will. This collective intelligence reduces blind spots and expands your possibilities—whether that’s minimizing tax impact, unlocking capital for growth, or safeguarding assets from market volatility and unforeseen events.

Customized Strategies for Complex Needs

We recognize that no two clients share the same financial blueprint. Some may focus on building a retirement income plan, while others require sophisticated trust structures, advanced tax planning, or tailored liquidity strategies.

The Financial Board of Directors model allows us to design a fully integrated plan, while also collaborating directly with your outside professionals—such as attorneys, accountants, or business consultants—so everyone works from the same playbook. That level of alignment ensures nothing is overlooked.

The Cost of Misalignment

When multiple parties work for the same client but rarely communicate, it can lead to unintended consequences—missed tax savings, inefficient asset transfers, or exposure to unnecessary risk.

Our model eliminates those gaps. Through structured communication and regular strategy reviews, your Financial Board of Directors ensures every aspect of your wealth plan works together toward the same outcome: preserving what you’ve built, maximizing what it can become, and ensuring it’s transferred according to your wishes.

A Smarter Way to Navigate Complexity

Whether you’re accumulating assets, managing them for income, or preparing to transition them to the next generation, the stakes are high. Our multi-disciplinary team meets those stakes head-on with strategic insight, proven processes, and a deep understanding of both opportunity and risk.

And the best part? This approach doesn’t add extra cost—it simply delivers more value.

Experience the Prevail Difference

When your financial life is managed by a Financial Board of Directors, you gain more than advice—you gain a strategic advantage. The coordination, perspective, and foresight that come from a unified team can help ensure your wealth works harder, lasts longer, and achieves more.

If your financial strategy deserves a team as sophisticated as your goals, connect with Prevail Innovative Wealth Investment Advisors and experience the difference for yourself.